The Excel template this article is based on, as well as a full explanation of it that includes part 1, can be requested from MyWealth Investments by e-mailing info@mywealthinvestments.co.za.

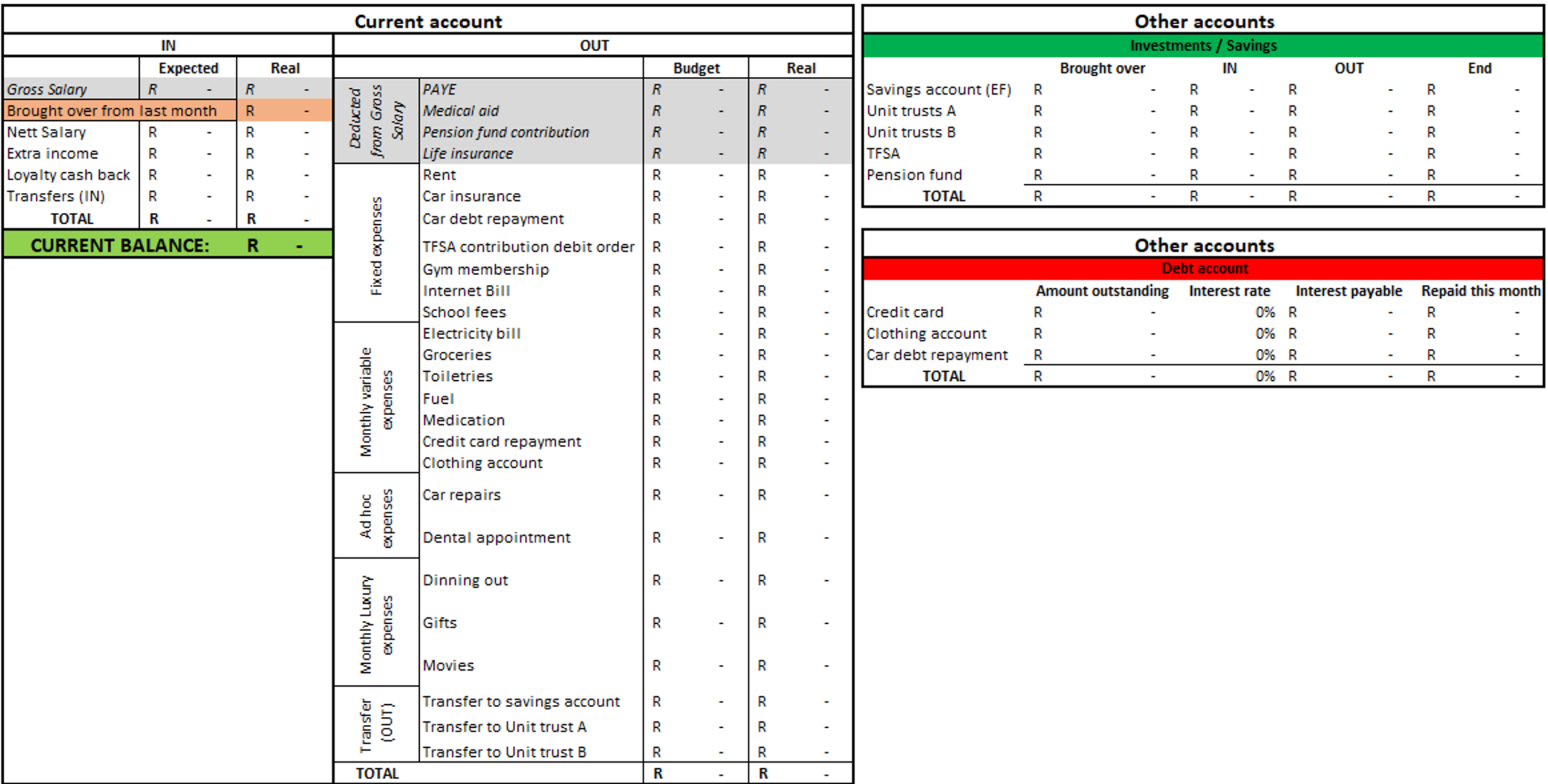

In last week’s article, we started the discussion based on the budget template, as shown below. It is important to remember that the “current account” box shown below is your transactional account that keeps track of all money that is flowing in or out of this account. The “Current balance” in light green should correspond with what you are seeing as the balance in your banking app.

We will continue the discussion by moving on to the “OUT” section in the “current account” box. There are subsections where the expenses will be classified and listed according to the most important “need to pay” expenses to the lesser urgent “want to spend” expenses. At the bottom, any money that will be transferred out of the current account into savings or investments will also be listed.

Understanding and Managing Fixed and Variable Expenses

The fixed expenses at the top are those that are paid every month and are known amounts, while the variable expenses are also paid every month, but the amount will differ depending on needs. Allocating a budget at the beginning of the month to these variable expenses and luxury expenses is important and should be kept in mind when spending money. Of course, there may be times when you will spend more money than what was budgeted for, but this will keep you mindful of how often and how much you spend over your budget.

Managing Savings, Emergency Fund, and Current Account Balances

To the top right, all saving accounts and investments are listed from most liquid to least liquid. A savings account with your bank can be used as an emergency fund. Most banks offer a savings account with a slightly higher interest rate than the current account. Using this account works great for an emergency fund as it is a ring-fence and separate savings in a liquid account and can easily be transferred from or into the current account simply on a banking app. Remember the golden rule – your savings account, or emergency fund, should hold at least three to six months’ worth of your nett income. Emergency and ad hoc expenses are usually paid from this account and if it is used, make sure to top up the current account and show it in the “IN” section. If funds from the emergency fund are used, topping it up again, before investing in less liquid investments, must be prioritised.

If funds are left over in your current account balance at the end of the month, consider using some of it to repay expensive debt or to top up the emergency fund. Remember to also show it as an “OUT” item when allocating it as it will be flowing out of the current account. This will ensure your “balance” remains in line with the amount reflected in your banking app.

To the left of the “savings/investment box” the starting values of each account will be shown and right from it, any funds coming in or withdrawn from the accounts will be shown. The “END” value to the far right will be the “brought over”, or “starting” value placed in this box next month.

The final box on the sheet will show all debt accounts that are outstanding. List these accounts from those with the highest interest rate to the lowest interest rate to serve as a reminder which needs to be repaid first if you have any additional funds.

Remember that this basic template can be built out even further by colour-coding certain expenses or funds that flow from different accounts, using conditional formatting. Charts, pivot tables and filters can also be included to visually show a snapshot of your finances.

Each person’s Excel budget workbook will ultimately look different, but this template and article can serve as a framework for how to think about setting it up. It is important to understand that this is a two-part process that requires you to put in the work at the beginning of each month to set up the budget, but that recording actual funds that flow from your accounts must be done throughout the month. Incorporating this practice into your life will without a doubt be one of the best things you can do for your financial well-being. You will not just be taking ownership and being proactive with your spending, but you will start to get a clear idea of where you are perhaps wasting money within a couple of months of doing this.