The importance of taking ownership of your finances and being pro-active with your spending and investing cannot be emphasised enough. The best way to do this is by starting to keep track of your financial behaviours and setting a realistic budget that will guide your decisions. Although there are a few tools available to assist in this matter, Excel has been one of the most robust and commonly used tools to keep track of financial matters and for building a budget.

Unlocking Excel’s Potential: Tailoring Your Workbook to Your Needs

The reason that Excel is such a useful and powerful tool, is that it allows you to fully customise it and create something that fits your personal situation best. The template provided and the sections in this two-part series of articles, speaking to this template can of course be used only as a guideline that can in future be built on or changed to accommodate your situation.

Step one is creating a new workbook and saving it somewhere you can easily find it, such as the top right corner of your desktop, since it will likely be a workbook you open on a regular basis. It is highly recommended that you save it on a secure cloud feature as this can have two important benefits. Firstly, it will ensure you don’t lose it if something happens to your computer. Secondly, it can easily be updated on your phone or another device making it much easier and efficient to update or check.

Securing Your Budget Workbook: Protecting Your Financial Details and Tracking Progress

As part of the initial step of setting up your budget workbook, make it a priority to take the necessary measures to secure it with some sort of protection such as a password. This workbook will most likely contain very detailed personal information which you might not want to fall into the wrong hands. You can set up a password by going to “File” > “Info” and then selecting the “Protect Workbook” box, followed by “Encrypt with Password” and follow the instructions.

Create a new sheet for each month by making a copy of your previous month’s sheet and deleting the values that will be updated for this month. Rename each new sheet according to the month you are updating it in. The benefit of doing it this way is that you are creating a history you can go and look back on. The value of having a record of your previous expenses, income, savings, and investments cannot be underestimated as it can help you set-up realistic financial goals in the future and inform your own financial behaviours.

Securing Your Budget Workbook: Protecting Your Financial Details and Tracking Progress

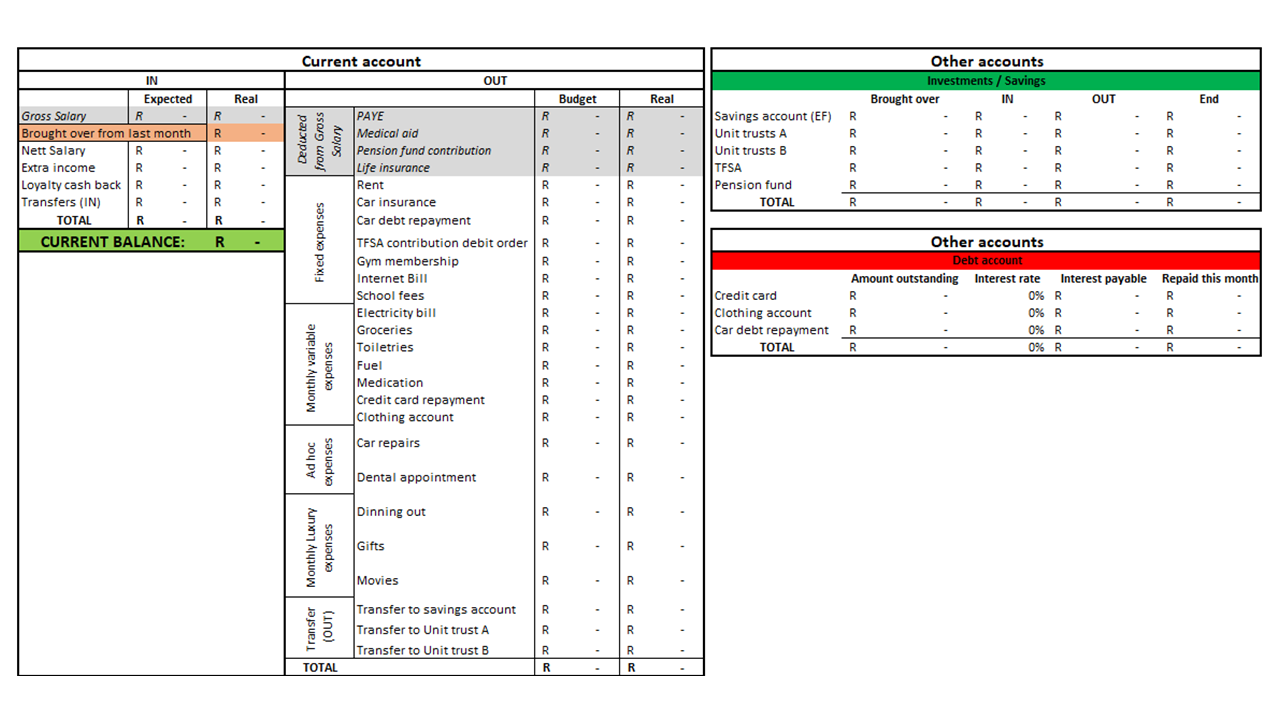

As can be seen in the image above, there will be three main boxes that are updated monthly. The first box, “Current account” can be thought of as your “piggy bank” or transactional account from where money will be flowing in and out of. On the left of this box, there is a section labelled “IN” which refer to any money coming into your account while the right is labelled “OUT” which is where money flowing out of your account will be listed. At the top of both these sections you will notice items marked in grey. These items are not actually coming in or going out of your account, but it is still good to list them for record keeping purposes. These grey items will correspond with your salary slip and note that they will not be included in the “total” marked at the bottom considering that they are not in reality flowing through your current account.

“Brought over from last month” will be any funds that remained in the current account during the previous month. If this is a significant amount it is advised to either use some of it to repay expensive debt or to top up your emergency fund before bringing it over to this month. Keep record of such a flow out of the current account in your previous month’s sheet.

Your “Nett salary” is the amount your employer pays into your bank account and any other money received during the month can be listed here, such as “loyalty cash backs” received for example. It is important to understand that this section is specifically labelled “IN” and not “income” since you would want to also list money here that you may transfer from your emergency fund into your current account to pay for unexpected expenses.

The “CURRENT BALANCE” in green is simple the difference between all the funds that came into your current account and that which has been spent or have flown out to investments. A simple calculation of subtracting the total “real OUT-flows” from the total “real IN-flow” items at the bottom will result in this amount and should match up to what is reflecting in your banking app’s balance for the current account.

The excel template that this article is based on, can be requested from MyWealth Investments by e-mailing info@mywealthinvestments.co.za.

In next week’s article we will discuss the remaining sections of this budget template in detail to ensure you are equipped to effectively build your own budget within this framework.