Students who want to pursue careers in commerce often face tough choices when considering an undergraduate programme as their launch pad for a successful career.

Lots opt for the most popular courses available. But doing this means that when you graduate, so will many others … leaving you competing fiercely with them for jobs, and without any distinct advantages to put you ahead of them in the interview queue.

Table of Contents

- A BCom is a generalist qualification

- A BCompt is a specialised degree

- The journey to becoming a chartered accountant

- Other accounting science job opportunities

- Compare typical curricula for the Bcompt and the BCom

- Regenesys Graduate Attributes

- Difference between Bachelor of Accounting Science and BCom in Accounting – FAQ

A BCom is a generalist qualification

While both a Bachelor of Commerce (BCom) and a Bachelor of Accounting Science (BCompt) are three-year qualifications, the BCom is a generalist degree. It lays sound foundations in business, with accounting as a major, as well as a business specialism such as marketing or human resource management.

A BCompt is a specialised degree

The BCompt, however, is a specialised accounting degree that incorporates business only in as far as is needed to provide a context for accounting. This programme develops professional knowledge, skills, and applied competencies in the fields of accounting, auditing, management accounting and taxation. It is a stepping stone towards becoming a professional accountant.

Many who opt for a Bachelor of Business Administration (BBA) or a Bachelor of Commerce (BCom) will simply have to settle for any entry-level position when they graduate.

The journey to becoming a chartered accountant

An elite corps of BCompt students set their sights somewhat higher. While a Bachelor of Accounting Science will help you qualify for various accounting designations with different professional bodies, if you want to go on to become a chartered accountant – the crème de la crème of professional certifications – you will need to go on to complete a postgraduate diploma in accounting to prepare for the Certificate in Theory of Accounting (CTA) exam.

You cover most of the groundwork for this in your BCompt; the fourth year of study will help you polish application of what you have learnt to enable you to complete the CTA exam. Thereafter you will be eligible for a three-year learnership with a registered training office. During this period, you must complete two qualifying examinations: the Initial Test of Competence and the Assessment of Professional Competence. Once you have completed the initial test and a 20-month internship with an accredited training office, will be able to sit the Assessment of Professional Competence. Once you have passed that, you will be eligible to register with the South African Institute of Chartered Accountants as a chartered accountant, and the accounting science jobs open to you thereafter are likely to carry very attractive salaries. Then there’s also the possibility of starting up your own financial or advisory practice.

Other accounting science job opportunities

You might also consider using your Bachelor of Accounting Science to become a tax specialist, auditor, financial advisor or manager, a fund manager, a consultant, a financial analyst, or certified financial officer.

In addition, it’s worth considering that many top posts in business are occupied by former accountants, particularly those of CEO and CFO.

Compare typical curricula for the Bcompt and the BCom

A typical curriculum for each programme is outlined below so you can compare them.

|

Bachelor of Accounting Science (BCompt) |

Bachelor of Commerce (BCom) | ||||||

|

Year 1 |

Year 2 |

Year 3 |

Year 1 |

Year 2 |

Year 3 | ||

| Financial accounting | Financial accounting | Financial accounting | Accounting | Accounting | Accounting | ||

| Business management | Auditing | Auditing | Business management | Business management | Business management | ||

| Economics | Taxation | Taxation | Economics | Entrepreneurship | Entrepreneurship | ||

| Business communication | Management accounting | Cost and management accounting | Human resource or marketing management | Economics, or human resource or marketing management | Economics, or human resource or marketing management | ||

| Mathematics | Statistical analysis | Risk and financial management | Statistics | Commercial law | |||

| Commercial law | Company law | Corporate governance | |||||

| Computer skills | Accounting in a computerised environment | ||||||

| Business ethics | |||||||

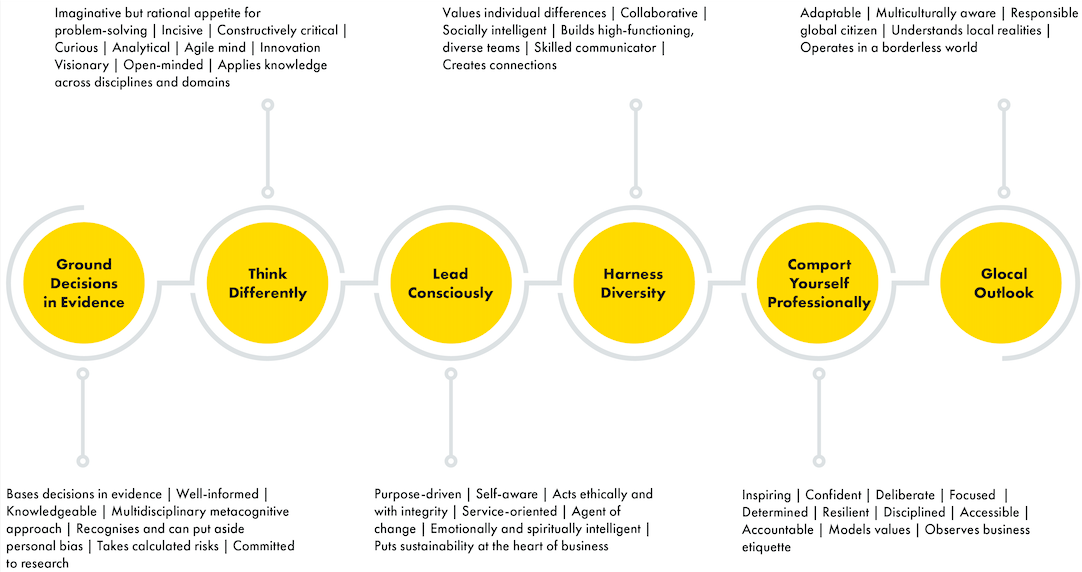

The Bachelor of Accounting Science offered by Regenesys also emphasises, in the teaching and learning process, the development of Regenesys graduate attributes – professional values – so highly desired by top organisations. They are the soft skills that make it easy to work with others, and which help to balance the technical skills that are the basis of your qualification.

Regenesys Graduate Attributes

Where to find more about the BCompt

Want to know more about the Bachelor of Accounting Science? Click here.

Difference between Bachelor of Accounting Science and BCom in Accounting – FAQ

What is the main difference between a Bachelor of Accounting Science and a BCom in Accounting?

The primary difference lies in the focus of the curriculum. A Bachelor of Accounting Science is more specialized, concentrating heavily on accounting, auditing, and taxation subjects. In contrast, a BCom in Accounting offers a broader business education, covering not only accounting but also management, economics, and business law.

Which degree is better for pursuing a career as a Chartered Accountant (CA)?

Both degrees can lead to a career as a Chartered Accountant, but a Bachelor of Accounting Science is often preferred for this path. This degree is designed to meet the specific requirements for becoming a CA, providing a more direct and focused route.

Can I pursue postgraduate studies with either degree?

Yes, both degrees provide a strong foundation for postgraduate studies. However, the Bachelor of Accounting Science may be more advantageous for those planning to pursue specialized qualifications in accounting or finance, while a BCom in Accounting could be better for broader business-related postgraduate programs.

Which degree offers more flexibility in terms of career options?

A BCom in Accounting generally offers more flexibility, as it covers a wider range of business disciplines. Graduates with a BCom can pursue careers in various fields such as marketing, management, and finance, in addition to accounting-specific roles.

How do the entrance requirements differ between the two degrees?

Entrance requirements may vary depending on the institution. Typically, a Bachelor of Accounting Science program may have more stringent requirements in mathematics and accounting due to its specialized nature. On the other hand, a BCom in Accounting might have slightly broader entry criteria, considering its more general business focus.