Pursuing a finance degree in South Africa offers many opportunities in banking, investment, corporate finance, and more. It equips you with the essential skills to navigate and excel in the finance industry. These programmes give students a foundation in financial principles, investment strategies, and economic analysis, enabling them to contribute effectively to South Africa’s thriving economy.

So, if you are proficient in maths and have a strong analytical mind, a career in finance could be your perfect fit. However, most roles in this industry require solid educational qualifications, often starting with a finance degree.

In this article, we will explore the various finance degrees in South Africa and their career prospects. We will also discuss the essential factors to consider while choosing the right programme.

Table of Contents

- What are the Types of Finance Degrees?

- Finance Degree Programmes Offered By Regenesys

- What is the Difference Between Accounting and Finance Degrees?

- Importance of Online Finance Degrees

- Factors to Consider for Choosing the Right Finance Degree in South Africa

- Conclusion

- FAQs on Finance Degree in South Africa

What are the Types of Finance Degrees?

In South Africa, you will find different finance degrees, each tailored to meet specific educational and career goals. Whether you are starting or advancing in your career, you must understand the different types of finance degrees to choose the right path. So, here is an overview of finance degrees in South Africa:

- Bachelor’s Degree in Finance:

A Bachelor’s degree in Finance is the minimum requirement for any finance career. Typically completed in 3-4 years, this degree covers essential topics like accounting, financial management, and corporate finance. It provides the foundational skills needed for roles such as financial analyst, investment banking associate, or financial consultant.

Regenesys School of Finance offers programmes like the Bachelor of Business Administration in Banking and the Bachelor of Accounting Science.

- Honours Degree in Finance

An Honours Degree in Finance is a one-year programme designed to improve expertise in areas such as Corporate Finance, Portfolio Management, and Risk Management. It equips students with the theoretical knowledge and quantitative skills required to excel in the financial services industry.

As a result, graduates of this finance degree in South Africa are well-prepared for a successful career in private and public institutions where financial and investment management skills are in high demand.

- Master’s Degree in Finance

A Master’s Degree in Finance takes two years and focuses on specialised areas like trading, investments, and risk management. It gives you a competitive edge in the finance job market and can help you advance to senior-level positions. While not required for all roles, a master’s degree deepens your financial knowledge and boosts your career prospects.

Finance Degree Programmes Offered By Regenesys

Regenesys School of Finance offers finance degree programmes in South Africa designed to equip learners with advanced skills and knowledge in the financial sector. With a focus on delivering high-quality education, Regenesys provides well-structured programmes that prepare graduates for success in various finance careers. The following are the top programmes you can find to advance your career in finance.

- Bachelor of Business Administration in Banking: The Bachelor of Business Administration in Banking (BBAB) at Regenesys is designed to equip learners with management and leadership skills. Through its well-structured curriculum, our programme enables students to have a deep understanding of banking operations.

- Higher Certificate in Business Management in Credit Banking: This programme lays a strong foundation for the learners to excel in a career in banking. Hence, for those currently in or aspiring to join the private banking sector, this programme focuses on essential skills and knowledge needed for the retail banking sector.

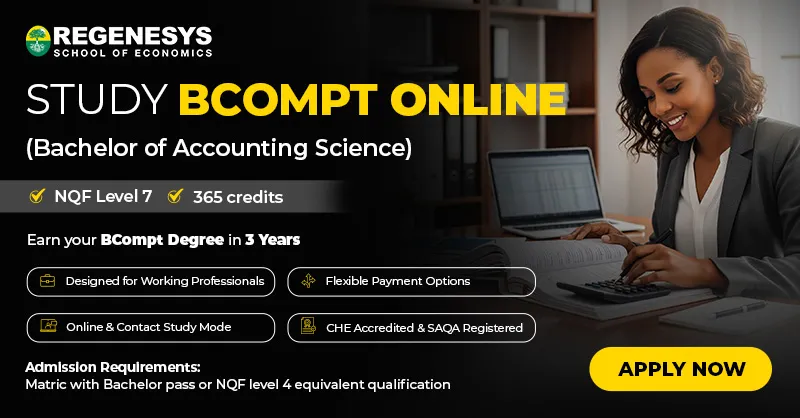

- Bachelor of Accounting Science: Learners can access this programme through both contact and distance learning. This programme offers in-depth knowledge and practical skills in accounting, auditing, financial management, and taxation. Moreover, it equips them with the expertise needed for a successful career in accounting.

To get admission to any of these bachelor’s programmes, you must have the following:

- Matric with a Bachelor pass or an NQF Level 4 equivalent qualification

- Relevant NQF Level 5 qualification from an accredited institution (SAQA approved)

- Proficient in Mathematics and have written and oral communication skills at NQF Level 4

To get admission to the higher certificate programme, you must have the following:

- Matric with certificate or diploma pass

- Basic computer skills

Also, read our article exploring the requirements for a BCOMPT programme at Regenesys School of Finance.

What is the Difference Between Accounting and Finance Degrees?

As you explore the finance degree in South Africa, it is essential that you know how it differs from an accounting degree. While both fields are integral to managing an organisation’s financial health, they focus on different aspects and require distinct skill sets. In the table given below, we will explore the differences between accounting and finance degrees:

| Aspects | Accounting Degree | Finance Degree |

| Focus | Evaluates and analyses the current and past finances of an organisation. | Prepares you for planning the financial future of an organisation. |

| Coursework | Financial accounting, reporting, cost management, auditing, accounting systems, accounting theory, income tax. | Banking, investments, financial analysis, financial planning, underwriting, portfolio management. |

| Skills Taught | Reporting, analysing, auditing, and evaluating financial records. | Planning, strategising, and forecasting, alongside strong analytical and mathematical skills. |

| Role in Business | Involves preparing accounting documents, conducting audits, and managing financial records. | Includes roles such as analyst or adviser, managing financial budgets, and consulting on financial strategies. |

You can also find out the top accounting jobs in South Africa.

Importance of Online Finance Degrees

Online finance degrees have become crucial for students balancing their studies with work or other commitments. Because of their flexibility and accessibility, these programmes allow students to study at their own pace, thus providing convenience and adaptability.

When compared with traditional finance programmes in South Africa, online degrees offer greater flexibility, often at a lower fee. They are a practical choice for working professionals seeking career advancement without pausing their employment.

On the other hand, traditional degrees provide the benefit of face-to-face interactions with faculty and peers. They enhance the learning experience through direct engagement and networking opportunities. So, if you are interested in online finance degrees, Regenesys School of Finance provides finance programmes through online study. This flexible option allows you to pursue your education from anywhere while balancing work or other commitments.

In short, each format has its unique advantages, and the choice depends on individual needs and circumstances.

Factors to Consider for Choosing the Right Finance Degree in South Africa

When you choose a finance degree in South Africa, you must ensure you get the best possible education and career preparation. The following are some of the important factors you need to consider while choosing the right finance degree:

- Reputation of the Institution: Select a well-recognised and accredited institution with a strong track record in finance education. Considering this factor will provide you with better networking opportunities and increase your employability.

- Course Scope: Assess whether the programme’s curriculum aligns with current industry practices and trends. A well-updated curriculum will prepare you for a workforce and ensure you are equipped with up-to-date knowledge.

- Personal Interests and Goals: When choosing a finance degree in South Africa, consider your personal interests and career aspirations. Doing this will help you make your educational experience more engaging and motivating.

Conclusion

As you pursue a finance degree in South Africa, you will find numerous opportunities in sectors such as banking, investment, and corporate finance. However, you must ensure you choose the finance degree that best suits your educational level, career goals, and interests. This will help you achieve professional growth and success. Therefore, consider factors like curriculum relevance and personal interests when you are choosing a programme for your finance career. In this article, we have explored the different types of degrees for finance, the difference between accounting degrees and finance degrees, and the factors to consider when choosing the right finance degree.

At Regenesys School of Finance, you will find programmes like the Bachelor of Business Administration in Banking (BBAB) and the Bachelor of Accounting Science (BCOMPT) to equip you with the essential skills and knowledge needed for a successful career in finance. Enrol now!

FAQs on Finance Degree in South Africa

What types of finance degrees are available in South Africa?

In South Africa, you can pursue various degrees for finance, including a Bachelor’s Degree in Finance, an Honours Degree in Finance, and a Master’s Degree in Finance. Each degree meets different educational and career goals, providing learners with foundational knowledge and skills.

What is the difference between accounting and finance degrees?

An accounting degree focuses on evaluating and analysing past and current financial records, including preparing financial statements and conducting audits. On the other hand, a finance degree is oriented towards planning and strategising for the financial future, involving skills in forecasting, investments, and financial management.

What are the benefits of pursuing an online finance degree?

Online degrees offer flexibility and convenience. They allow students to study at their own pace while balancing work or other commitments. They are often more affordable and helpful for working professionals seeking career advancement without interrupting their employment.

What factors should I consider when choosing a finance degree in South Africa?

Key factors to consider include the reputation of the institution, the relevance of the curriculum to current industry practices, and how well the degree aligns with your personal interests and career goals.

What are the top universities for finance degrees in South Africa?

Regenesys School of Finance is one of the top schools for finance degrees, offering programmes such as the Bachelor of Business Administration in Banking and the Bachelor of Accounting Science. These programmes prepare students to excel in finance careers, providing quality education and career-focused training in finance.