Deciding on a career can be daunting, especially when you have many similar options. If you are interested in accounting science or finance, you may wonder which path to take: accountant or auditor.

Understanding the differences between the two professions can help you decide which path is right for you.

In this article, let us explore the key differences between accountants and auditors and the skills required for success in each role. By the end of this article, you will clearly understand which career path best suits your interests, skills, and career goals.

Table of Contents

The Role of Auditor and Accountant

Accountants and Auditors are the two primary professions in the world of finance. While both professions deal with financial matters, they have different roles and responsibilities.

- The Role of an Auditor:

Auditor’s work is critical in maintaining transparency and trust in financial reporting.

Auditors play a crucial role in examining and verifying financial records to ensure accuracy, integrity, and compliance with applicable laws and regulations. They check financial statements, internal controls and operational processes to identify errors.

Auditors independently assess a company’s financial health and report their findings to management.

- The Role of an Accountant:

Accountants play a crucial role in the day to day financial operations. Their primary role is to prepare and maintain financial records and manage budgets. They keep track of income and expenses and ensure compliance with tax regulations.

Accountants provide valuable analysis, insights, and informed financial decisions to maximise business profitability.

The Responsibilities of an Auditor and Accountant

The Responsibilities of Auditors

An auditor is an authorised person who verifies the accuracy of financial records and ensures that companies follow tax norms.

The primary task of an auditor is to conduct a thorough examination of a company’s financial statements, including:

- Balance sheet;

- Income statement;

- Cash flow statement.

- They review these documents to identify errors, inconsistencies, or potential fraud.

Other responsibilities of Auditors include:

- Auditors are responsible for examining and evaluating financial records.

- Auditors are also responsible for assessing the internal controls of an organisation.

- Auditors play a critical role in ensuring the accuracy and reliability of financial information.

- Auditors also provide valuable insights and recommendations to improve the organisation’s control environment.

- Auditors perform detailed tests and analyses on various financial transactions and accounts.

- Auditors help organisations mitigate legal and regulatory risks by conducting comprehensive compliance reviews.

- Auditors prepare detailed reports summarising their audit procedures, findings, and recommendations.

Thus, the responsibilities of an auditor involve examination, evaluation, and verification of financial records, internal controls, compliance, and reporting.

The Responsibilities of Accountants

Accountants are meticulous and detail-oriented professionals. They have strong analytical skills and an understanding of financial principles and regulations.

Accountants’ responsibilities encompass a broad range of financial tasks. Accountants play a vital role in making them essential contributors to organisations’ success.

Listed below are some of the primary responsibilities of an Accountant:

- Accountants play a crucial role in managing the financial affairs of organisations.

- Accountants’ responsibilities encompass various financial tasks and are vital for an entity’s smooth operation and decision-making processes.

- Accountants are responsible for recording, analysing, and reporting financial transactions. They also ensure the accuracy and integrity of financial records.

- Accountants also play a pivotal role in managing budgets, financial planning and making recommendations to improve financial performance.

- Accountants guide tax strategies to cut liabilities and maximise deductions. They assist in forecasting future financial needs.

- Accountants also check cash flow, manage accounts, conduct financial audits, and ensure compliance with regulations and internal policies.

- Accountants are often involved in tax compliance and planning. They prepare and file tax returns for businesses, ensuring adherence to applicable tax laws and regulations.

Key Differences Between the Roles of Auditors and Accountants

When considering a career in finance, it is essential to understand the critical differences between the roles:

Both accountant and auditor professions deal with financial information. They both have distinct focuses and responsibilities.

Accountants vs. Auditors:

| Accountants | Auditors |

| Accountants primarily work within organisations. | Auditors are independent professionals. |

| Accountants maintain financial records and prepare financial statements. | Auditors assess and check financial records and statements. |

| Accountants are responsible for tracking income, expenses, and assets. | Auditors are responsible for ensuring that the provided financial information is reliable. |

| Accountants ensure that financial data is accurate and current. | Auditors ensure that the provided financial information complies with applicable laws and regulations. |

| Accountants help businesses manage their finances by providing insights to improve financial performance. | Auditors conduct examinations of financial and internal records, controls, and processes for irregularities. |

The Bottom Line

Certain factors must be considered while considering which profession is right for you.

These factors include essential evaluation of your strengths, preferences, and career goals.

Suppose you enjoy working with numbers, analysing financial data and providing financial insights. Then, a career as an accountant may be a suitable choice.

If you enjoy conducting thorough examinations, have a passion for ensuring financial transparency. Then, a career as an auditor may be a suitable choice.

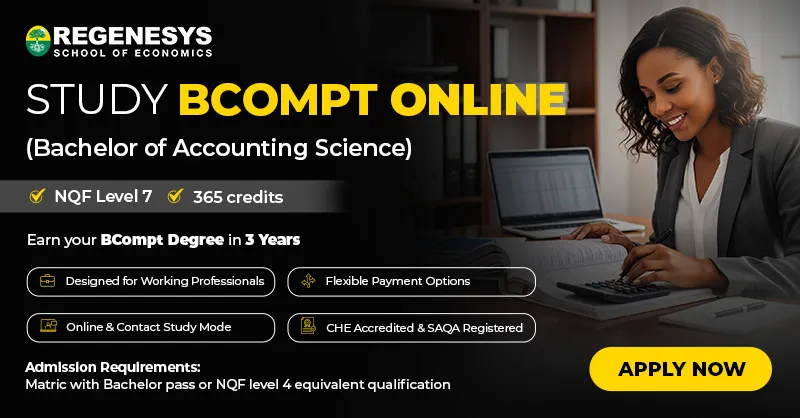

Stay tuned with Regenesys Business School to develop your professional knowledge, skills, and applied competencies in accounting science, auditing, management accounting and taxation. Click here to learn more about the accounting science course details, accounting science requirements, accounting science job, and the accounting science Regenesys modules.

FAQs – Frequently Asked Questions: Auditor vs Accountant: Choosing Your Career Path

What is the primary role of an Auditor?

Answer: Auditors’ primary role in:

Ensuring transparency and accountability, providing an unbiased assessment of an organisation’s financial health.

What is the primary difference between an Accountant and an Auditor?

Answer: The critical difference lies in their focus and level of independence.

Accountants work within organisations, actively managing and reporting on financial information, while auditors work externally to verify and validate financial data.

What factors to consider when choosing a career between an Accountant and Auditor?

Answer: Choosing a career depends on your interests, skills, and career goals. When deciding on a career as an accountant or an auditor, there are several factors to consider, such as:

Career progression;

The nature of the work;

The work environment.

What skills and qualifications are required for pursuing a career as an Accountant?

Answer: An Accountant requires a specific set of skills and qualifications.

The essential skills required to become an accountant include:

Mathematical skills;

Strong Communication skills;

Specialised Accounting skills;

Organisation and attention to detail;

Analytical and problem-solving skills.

In terms of qualifications, a Bachelor of Accounting Science, bachelor of science in accounting, or a related field is typically required to enter the profession.

Many accountants also pursue higher certificate in accounting sciences or advanced certifications such as Certified Public Accountant (CPA) or Chartered Accountant (CA)

These skills and qualifications may vary with the job profile and the organisation.

What are the different specialisations of accounting?

Answer: Accountants can specialise in different types of accounting depending on their career interests and goals.

There are the nine most common types of accounting:

Auditing

Tax accounting;

Cost accounting;

Public accounting;

Forensic accounting;

Financial accounting;

Managerial accounting;

Governmental accounting;

Accounting information systems.