In South Africa, the accounting industry is a strong force behind the foundation of compliance and business transformation. Accounting is essential to all the major industries in the country, from energy and mining to agriculture and banking.

On the other hand, the auditors also play a vital role in public accountability in this country. They ensure that an organisation’s stakeholders can trust the reported financials.

If you are a student aspiring to get into any of these professions, you should have an idea about the different programmes that you can pursue. The programmes can be of different NQF levels, and it is essential to understand them.

This article will serve as a guide in this regard and inform you about the relevant details.

Table of Contents

NQF Levels Explained

To understand in simple terms, consider the different NQF levelsas steps on a career ladder. The more levels you progress, the higher or more advanced the qualification and skills gained.

Generally, the NQF levels represent these academic and vocational levels:

Level 4: Matric or school-leaving certificate

Level 5: Higher certificate

Level 6: Diploma or advanced certificate

Level 7: Advanced diploma, bachelor’s degree or postgraduate certificate

Level 8: Honours degree or postgraduate diploma

Level 9: Master’s degree

Level 10: Doctoral degree

You must note that the qualifications offered as per NQF levels can vary across institutions.

Read about Online Bachelor of Accounting Science Degrees: Pros and Cons.

Why Knowing the NQF Levels Matters?

Having an idea about the NQF levels helps you understand where you are in your academic career and where you can aim to go next. Here’s a detailed account of this, along with other pointers:

- Understand your current position: Knowing the NQF levels lets you recognise how your current qualifications align with them. Having this clarity helps map out the path ahead in your academic career.

- Set your ultimate goal: By opting for the programme at the appropriate NQF level, you can set your objective accordingly.

- Verifying prerequisites: There are some specific prerequisites associated with every NQF level. Candidates need to meet these requirements to qualify for entry into a programme. Having a detailed understanding of the levels and their prerequisites can help you in your academic journey.

- Stay updated: The education landscape is evolving. Being aware of the NQF levels, changes in them, their programme offerings, and industry requirements will help you stay updated. This can further help you make informed decisions for your academic career.

Know the Salary Expectations for Bachelor of Accounting Science (BCOMPT) Professionals.

Accounting and Auditing Qualifications as per NQF Levels

There are several accounting and auditing qualifications offered by the South African institutions at different NQF levels. Given below are some of the well-known qualifications in this field, along with their NQF levels.

Have a look at them:

NQF Level 5 Qualifications

NQF level 5 is the first level of qualification after completing school. These mostly include higher certificates, certificates and some diplomas.

Have a look at some of the NQF Level 5 qualifications related to this field:

- Higher Certificate in Accounting

- Certificate: Accounting

- Diploma in Public Sector Accounting

- National Diploma: Technical Financial Accounting

- Occupational Certificate: Management Accounting Officer

NQF Level 6 Qualifications

These are the second level of qualifications after completing schooling. These mostly include diplomas and some advanced or higher certificates. These qualifications also allow individuals to gain entry-level designations for some of the professional accounting associations.

Here are some of the qualifications that you can consider:

- Advanced Certificate in Accounting Sciences

- National Diploma: Management Accounting

- Occupational Certificate: Management Accounting Specialist

- Diploma in Public Finance and Accounting

- Higher Diploma: Accounting

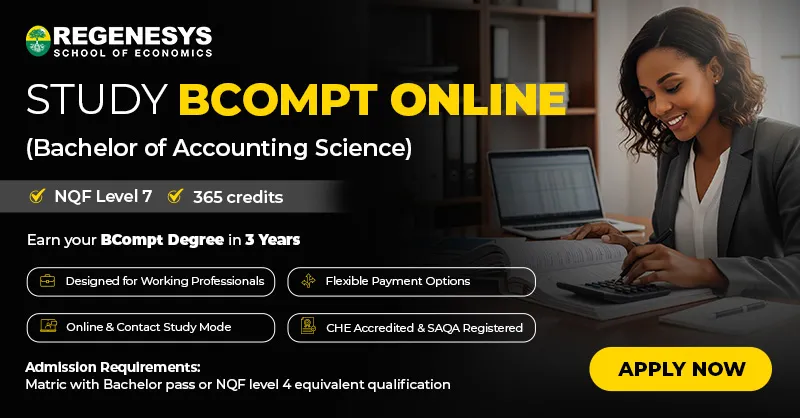

NQF Level 7 Qualifications

These qualifications mostly include advanced diplomas and three-year bachelor’s degrees. Individuals with this qualification can operate more independently in their professional accounting roles.

Have a look at some of the most well-known qualifications at this level:

- Bachelor of Commerce in Politics, Philosophy, and Economics

- Bachelor of Accounting Science (BCOMPT)

- Bachelor of Commerce in Accounting Sciences

- Advanced Diploma in Accounting

- Bachelor of Accounting Sciences in Internal Auditing

NQF Level 8 Qualifications

These are also considered postgraduate-level qualifications. Some of these include four-year bachelor’s degrees. There are also several one-year honours programmes that can be pursued after completing a relevant three-year bachelor’s programme.

Here are some of the NQF level 8 qualifications in this field:

- Postgraduate Diploma in Internal Auditing

- Bachelor of Commerce Honours in Accounting

- Bachelor of Commerce Honours in Accounting Science

- Postgraduate Diploma in Accountancy

- Postgraduate Diploma in Chartered Accountancy

NQF Level 9 Qualifications

Individuals with an NQF level 9 qualification are usually the ones who have completed a Master’s, which requires around 5 to 6 years of studies after completing school.

Have a look at some of these qualifications related to this field:

- Master of Accounting Science

- Master of Commerce in International Accounting

- Master of Accountancy in Financial Accounting

- Master of Accountancy in Taxation

- Master of Applied Accountancy

NQF Level 10 Qualifications

This level of qualification is the highest recognised one in South Africa. Individuals who opt for programmes of this level are usually more academically focused.

Have a look at some of the qualifications at this level:

- Doctor of Accounting Science

- Doctor of Commerce in Accounting

- Doctor of Philosophy in Accounting Sciences

- Doctor of Accountancy

- Doctor of Commerce in Accountancy

Gain insights into the Career Opportunities With A Bachelor of Accounting Science Degree.

Choose Regenesys as Your Learning Partner

If you are looking for a reputable institution to study programmes related to accounting and auditing, consider Regenesys Education.

The programmes here are internationally recognised and accredited by the Council on Higher Education.

Some of the programmes related to accounting and auditing that Regenesys offers are:

- Bachelor of Commerce in Politics, Philosophy, and Economics – NQF Level 7

- Bachelor of Accounting Science (BCOMPT) – NQF Level 7

- Postgraduate Diploma in Internal Auditing – NQF Level 8

The Feb 2026 intake applications for these programmes are now open.

Explore Our Other Programmes

Conclusion

Understanding the NQF levels is the first step that you can take toward a fulfilling career and academic trajectory.

Now that you have an idea about these levels in the accounting and auditing sector, you can take the necessary steps to map out this trajectory.

Choose Regenesys Education to pursue a recognised programme in this field. Visit the website and check the programme requirements today.

FAQs

How many NQF levels are in accounting?

Accounting qualifications span multiple NQF levels from Level 5 to Level 10.

What is the highest NQF level in accounting?

The highest NQF level in accounting is NQF Level 10.

How long are the NQF level 4 accounting programmes?

An NQF Level 4 accounting programme, such as the FET Certificate: Accounting Technician Qualification, takes around 12 months to complete. However, the duration can vary depending on factors such as programmes, institutions, and study format.

Can I do NQF level 3 accounting without an NQF level 2 qualification?

Some NQF level 3 accounting programmes, such as the Certificate: Accounting Technician Qualification, have open access. This means that there are no specific entry requirements. So you may be able to do NQF level 3 accounting without an NQF level 2 qualification. Confirm this with the official sources at your target institution.

Does AAT Level 4 make you a qualified accountant?

No, the successful completion of the AAT Level 4 makes you a qualified accounting technician. This is not the same as a chartered accountant.