Accountants play a vital role in managing an organisation’s financial health. They are responsible for recording financial transactions, preparing accurate reports, and ensuring compliance with laws and regulations.

Their work helps businesses make informed decisions, plan budgets, and maintain financial stability.

Table of Contents

- What Is An Accountant?

- What Are The Roles And Responsibilities Of An Accountant?

- Top Five Roles And Responsibilities Of An Accountant

- Accounting Roles and Salary Ranges in South Africa

- The Importance Of Accountants In Business

- Explore Our Other Programmes

- Conclusion

- Roles & Responsibilities Of An Accountant – FAQ

Key responsibilities typically include bookkeeping, analysing financial data, preparing tax returns, managing audits, and offering financial advice. Accountants help organisations stay organised, transparent, and financially secure.

In this article, we’ll explore the daily roles and responsibilities of an accountant, their salary ranges, why their work is essential to organisations, and the five key roles they play.

What Is An Accountant?

An accountant reviews and analyses financial records to track income, expenses, and tax obligations. They are crucial in project planning, cost analysis, auditing, and financial decisions.

Some specialise in tax preparation, ensuring adherence to tax laws and optimising financial strategies. Accountants work in various industries, such as large company finance departments and external accounting firms. They must meet specific educational and testing standards set by their state and obtain certification from professional associations.

- Accountants differ from bookkeepers because accountants usually hold at least a bachelor’s degree in accounting and interpret financial data rather than simply recording it.

- While accountants can handle bookkeeping tasks, not all bookkeepers have the qualifications of accountants.

- Accounting encompasses various roles, including public accountants who work with multiple clients, management accountants who focus on internal financial operations, and government accountants who manage public funds.

- Internal and external auditors also play crucial roles in ensuring financial integrity within organisations.

What Are The Roles And Responsibilities Of An Accountant?

Accountants are essential for an organisation’s financial health. They carefully track and analyse financial data to ensure accuracy and compliance with rules.

Their role goes beyond crunching numbers; they advise on financial planning, reporting, and decision-making. Let’s study the roles and responsibilities of an accountant and highlight how accountants contribute to business operations and financial management.

1. Daily Roles Of An Accountant

Accountants handle a wide range of tasks each day to keep a business financially organised and compliant. Their work supports smooth financial operations, ensures accurate reporting, and helps management make confident decisions.

From monitoring day-to-day transactions to maintaining financial stability, an accountant’s daily routine plays a vital role in an organisation’s overall success.

Let’s learn what accountants do daily to manage finances in and ensure companies follow regulations:

- Managing Financial Transactions: Accountants ensure all expenses are accurately recorded and categorised, maintaining compliant financial records. They oversee timely payments to vendors and staff and quickly meet financial obligations.

- Budgeting and Financial Management: Accountants play a crucial role in creating budgets and analysing operational costs to find ways to save money and improve efficiency. They also forecast future financial trends, providing valuable insights for making strategic decisions.

- Maintaining Financial Records: Accountants meticulously keep detailed records of financial transactions, ensuring data is accurate and accessible. At the end of each month, they compile comprehensive reports summarising the organisation’s financial performance.

- Account Reconciliation and Analysis: Accountants regularly reconcile accounts to ensure balances are correct, analyse financial trends to assess the organisation’s financial health, and promptly investigate and resolve any discrepancies to maintain financial accuracy.

- Interacting with Clients and Auditors: Accountants handle client invoicing with precision, ensuring accuracy and timeliness. During financial audits, they assist auditors by providing necessary documentation and explanations. They also contribute to various accounting projects that support organisational objectives.

2. Daily Responsibilities of An Accountant

The daily responsibilities of an accountant focus on accuracy, organisation, and financial oversight. They ensure business activities run efficiently by maintaining reliable financial information and supporting key processes.

Their role also involves working closely with teams and stakeholders, contributing vital insights that help drive strong financial performance and long-term growth.

Accountants perform essential daily tasks to keep a company’s finances healthy and compliant with regulations. They are:

- Handling Routine Financial Tasks: Accountants meticulously record expenses, review transactions for accuracy, and ensure timely payments to suppliers and other stakeholders.

- Preparing Financial Reports: They prepare detailed financial statements and balance sheets that provide a monthly overview of the organisation’s financial position and performance.

- Analysing Financial Data: Accountants analyse financial trends and operational costs to identify areas for cost-saving and efficiency improvements. They also forecast future financial scenarios to help in strategic planning and decision-making.

- Ensuring Accuracy and Compliance: Accountants maintain meticulous records to comply with financial regulations and standards. They promptly address any discrepancies or issues to uphold data integrity.

- Supporting Clients and Team: Accountants issue invoices accurately and collaborate on various accounting projects. They communicate financial insights to stakeholders, helping them make informed decisions that benefit the organisation.

Top Five Roles And Responsibilities Of An Accountant

Accountants are vital to organisations of all sizes and levels. Their responsibilities go beyond numbers to include strategic insights, ensuring compliance, and supporting decision-making.

Here’s a breakdown of the top five roles and responsibilities of accountants:

1. Financial Statement Preparation and Analysis

A core duty of accountants is preparing and analysing financial statements, such as balance sheets, income statements, and cash flow statements. These documents provide crucial insights into a company’s financial health.

In this area, accountants typically:

- Accountants collect and organise financial data from various sources and then analyse it to identify trends and anomalies affecting financial performance.

- Their detailed analyses help management make informed decisions to maintain business stability and drive growth.

2. Budgeting and Forecasting

Accountants are crucial in budgeting and forecasting, which is essential for organisational success. They develop budgets aligned with strategic goals by analysing financial health, historical data, market trends, and growth projections.

Within budgeting and forecasting, accountants usually:

- Through careful analysis and financial modelling, accountants create detailed budgets forecasting income, expenses, and investments.

- This foresight enables businesses to plan, seize opportunities, and navigate challenges proactively.

3. Tax Planning and Compliance

Another critical responsibility is navigating tax complexities. Accountants engage in tax planning to minimise liabilities while ensuring compliance with tax laws. They stay updated on tax codes, deductions, and exemptions to optimise tax positions legally.

When it comes to tax planning and compliance, accountants:

- Accountants prepare accurate tax returns and advise on tax strategies aligned with business goals.

- Their meticulous record-keeping and adherence to regulations reduce audit risks and ensure transparency.

4. Internal Controls and Risk Management

Accountants maintain the integrity of financial reporting through adequate internal controls and risk management. They assess risks, design control measures, and monitor their implementation to protect against financial vulnerabilities.

In terms of controls and risk, they typically:

- Accountants identify and mitigate risks that could impact financial performance and reputation, integrating risk management into organisational frameworks.

- Their collaboration with stakeholders ensures compliance with regulatory requirements and operational stability.

5. Financial Advisory and Decision Support

Accountants provide valuable financial advice and decision support beyond traditional roles. They offer expertise in financial forecasting, cost analysis, and investment evaluation. Accountants assist in budgeting and financial planning, optimising resource allocation for efficiency and profitability.

In their advisory and support function, accountants often:

- They assess business health by analysing key performance indicators and financial ratios and offer strategic recommendations for sustainable growth.

- Accountants are trusted advisors, helping businesses navigate financial complexities and achieve long-term success.

Accounting Roles and Salary Ranges in South Africa

Understanding the earning potential in the accounting field can help students and professionals choose the right career path. Salaries vary widely depending on the role, experience, and level of responsibility. According to Talent.com, below is a quick breakdown of popular accounting positions and their average salary ranges in South Africa:

| Accounting Role | Key Responsibilities | Average Salary (South Africa) |

| Junior Accountant | Handles bookkeeping, captures transactions, and assists with reconciliations. | R300,000 per year |

| Auditor | Reviews financial records, checks compliance, and identifies risks. | R5,340,000 per year |

| Financial Analyst | Analyses financial data, prepares forecasts, and supports business decisions. | R840,000 per year |

| Management Accountant | Prepares budgets, monitors costs, and supports financial planning. | R378,000 per year |

| Tax Accountant | Manages tax returns, ensures compliance, and provides tax planning advice. | R378,000 per year |

| Senior Accountant | Oversees financial processes, prepares reports, and ensures accuracy. | R420,000 per year |

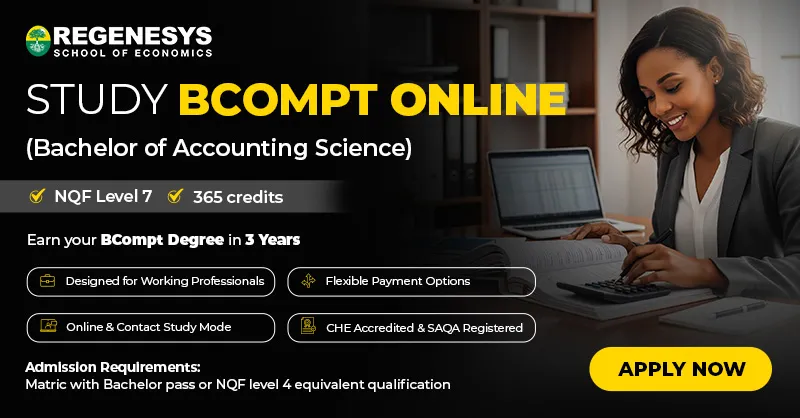

Interested in becoming a professional accountant or building a successful career in finance? Explore the Regenesys BCom in Banking and Financial Services Accounting programme and start building your future in finance.

The Importance Of Accountants In Business

Accountants are vital assets to any business, ensuring financial health and regulatory compliance. They manage finances, ensure financial statement accuracy, and advise on strategies to enhance profitability and reduce costs. This proactive approach stabilises finances and fosters long-term growth.

The following are the importance of accounting in business:

1. Informed Decision-Making

Accountants analyse financial data to offer critical insights. They identify trends, risks, and opportunities, empowering businesses to improve performance and capitalise on growth prospects.

Financial forecasting and budgeting help companies navigate uncertainties with confidence.

2. Tax Planning and Compliance

Navigating tax laws is essential to avoid penalties and maximise savings. Accountants specialise in tax planning, minimising liabilities, and ensuring compliance.

Their expertise in deductions and financial reporting ensures businesses operate efficiently within legal boundaries.

3. Optimising Cash Flow

Maintaining cash flow is vital for business continuity and growth. Accountants identify opportunities to reduce costs and strategies to increase revenue.

Their financial insights help businesses manage liquidity and strengthen their market position.

4. Facilitating Mergers and Acquisitions

Accountants provide financial analysis during mergers and acquisitions. They evaluate partners and assess financial impacts, ensuring informed decisions, protecting investments and minimising risks.

5. Outsourced Accounting Services

Accounting BPO services have revolutionised financial management by offering expertise in everything from bookkeeping to complex analysis. This enhances accuracy and efficiency, allowing businesses to focus on core activities while ensuring financial transparency.

6. Strategic Financial Planning

Accountants collaborate with business leaders to develop financial strategies aligned with organisational goals. They advise on investments and retirement planning, supporting sustainable growth and resilience against economic changes.

Explore Our Other Programmes

Conclusion

Accountants play a crucial role in businesses by managing financial records and offering strategic advice. They are trusted advisors who help navigate complex financial situations, ensuring accurate reporting and compliance.

Their expertise enables businesses to make informed decisions, identify cost-saving opportunities, and enhance financial performance. Whether you’re an entrepreneur, small business owner, or simply interested in accounting, understanding their pivotal role is key to succeeding in this business world.

Improve your capabilities and professional knowledge in accounting science.

Gain specialised knowledge and explore career opportunities with Regenesys School of Finance.

Enrol today!

Roles & Responsibilities Of An Accountant – FAQ

What does an accountant do?

Accountants manage financial transactions, prepare reports, analyse data, and ensure financial compliance for businesses.

How do accountants contribute to financial management?

Accountants assist in budgeting, financial forecasting, cost analysis, and identifying ways to improve efficiency and reduce costs.

What are the core responsibilities of an accountant?

Core responsibilities include financial statement preparation, budgeting, tax planning, internal controls, and financial advisory.

Why are accountants essential for businesses?

Accountants ensure financial accuracy, compliance with regulations, and provide strategic financial advice crucial for business stability and growth.

What is the difference between an Accountant and a Bookkeeper?

While both handle financial data, accountants interpret and analyse financial information, whereas bookkeepers primarily record financial transactions.

What types of industries do accountants work in?

Accountants work in various industries including corporate finance departments, accounting firms, government agencies, and nonprofit organizations.

What qualifications do accountants need?

Accountants typically hold at least a bachelor’s degree in accounting or a related field and may pursue certifications like CPA or ACCA.

What role do accountants play in tax preparation?

Accountants prepare tax returns, advise on tax strategies, and ensure businesses comply with tax laws to minimize liabilities.

How do accountants support financial audits?

Accountants assist auditors by providing accurate financial records, explanations of transactions, and ensuring compliance with audit requirements.

What skills are essential for accountants?

Essential skills include analytical skills, attention to detail, proficiency in accounting software, and strong communication skills.

What are the career paths for accountants?

Accountants can specialize in areas such as tax accounting, management accounting, auditing, forensic accounting, and financial analysis.

How do accountants help in financial decision-making?

Accountants provide financial analysis, forecasting, and budgeting insights that inform strategic decisions to improve business performance.

What is the significance of financial reporting for accountants?

Financial reporting by accountants provides stakeholders with accurate financial information that guides decision-making and ensures transparency.

How do accountants assist in internal controls?

Accountants design and implement internal controls to safeguard assets, ensure data accuracy, and mitigate financial risks within organizations.

How can businesses benefit from outsourced accounting services?

Outsourced accounting services enhance accuracy and efficiency in financial management, allowing businesses to focus on core operations and growth strategies.