Why should you have a “life” file?

Although your end of life is not pleasant to think about, it is part of life and a reality that awaits us all.

Generally, when we think about death we think about funeral cover, yet we forget about the importance of keeping a filewith all our valuable documentation, included bank account PIN codes and media passwords.

Besides the importance of having a will and funeral cover, it is also important to keep a file with contact details and copies of information required to register and administer the deceased estate.

By compiling and maintaining a file with the documentation needed when you are not around, you will reduce stress for your loved ones when making the funeral arrangements and make it easier for the executor to wind up the estate in accordance with your wishes. Today’s electronic world makes it difficult for you executor and your survivors to have access to your personal online documentation.

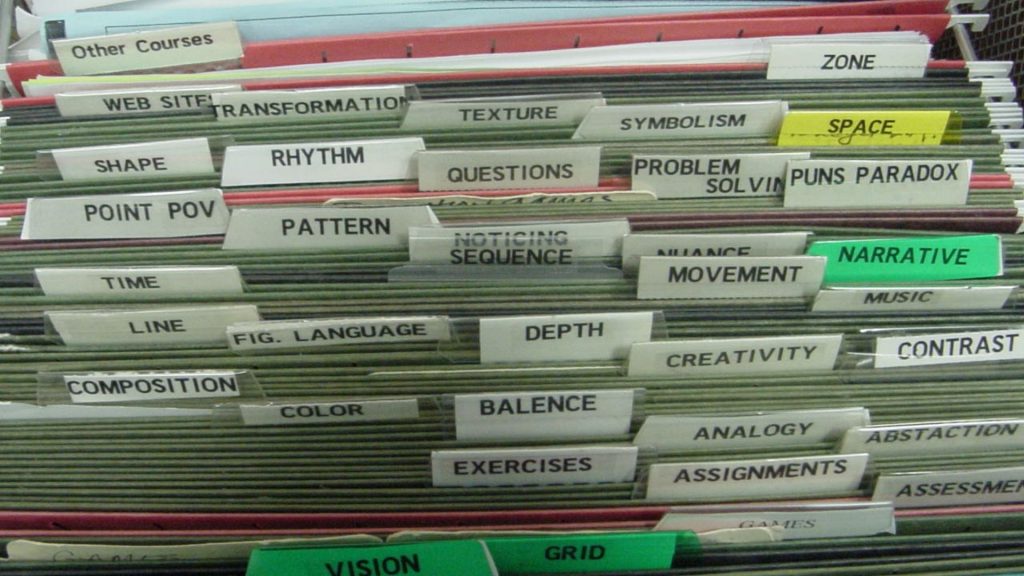

It is good practice to keep the following documentation in your “Life“ file:

General information

- Contact details of next-of-kin to contact in the case of something happening to you;

- A list of contact numbers of everyone who needs to be informed about your death;

- Your current employer details and employee number;

- The contact details of your lawyer, financial advisers, doctors and tax practitioner who need to be informed when you pass away;

- Identity document, passport and driver’s license;

- Copy of your last Will and Testament as well as contact details of where to obtain the original document;

- Unabridged birth certificates for each family member;

- If applicable marriage certificate/registration of customary marriage;

- If applicable, a copy of your antenuptial contract;

- If you are divorced, contact details of former spouse and copies of divorce order and maintenance agreement;

- If you are widowed, a certified copy of your late partner’s death certificate, and contact details of the executor who attended to the deceased estate;

· Copy of your and your partner’s Income tax assessments;

· Copies of TV license, Cellular phone contract, DSTV contract, internet services provider contract, golf club membership, gym contract, and a copy of your utility bill.

Financial Information

- For fixed properties, you need to include the title deeds of your properties (if you have a bond over the property, the title deed should be with the bank);

- You will also need a home loan statement/lease agreement, details of any credit life cover and capital gains tax valuations.

- Car ownership (including trailers, motor bikes, boats, caravans etc) documentation including registration certificates and a finance agreement or statement;

- Firearm owners need to also keep copies of the firearm licences, competency certificates as well as details of ammunition held;

- Passwords, pins and bank account details for all bank accounts;

- Copies of insurance, funeral and endowment policies, annuity, pension fund, medical insurance, medical aid and gap cover you have, as well as contact information to reach the insurance companies;

- A comprehensive list of investments for example in unit trusts, income plans and share portfolios (Computershare statements and share/stock/bond certificates);

- Prepare a list of debit orders, when they go off, amounts thereof and a list of accounts that need to be closed;

- Copy of your short-term (house and car) insurance policy schedule;

Social Media Information

It is important to leave instructions to assist with the close of your digital life.

- Include your cell phone/computer password.

- Usernames and passwords to any social media accounts.

- A list of any other devices where action needs to be taken, for example, returning a laptop to work.

Lastly but surely not the least, it is very important to ensure that you keep the documents stored in a safe place. Ideally you should keep the documents in hard copy and in a folder saved in the cloud and only share this information with somebody you can trust.

A comprehensive Life File is the final act of a life well lived. Do it now.