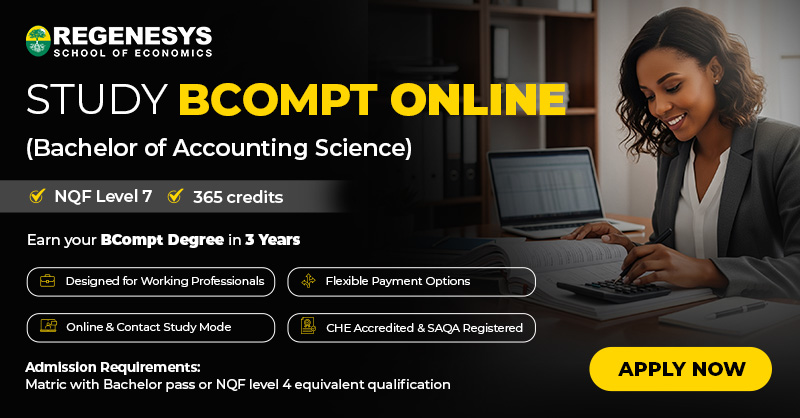

The Bachelor of Accounting Science (BCompt) at Regenesys School of Finance is a comprehensive programme designed to equip students with a strong foundation in accounting principles and practices. Let’s break down the core subjects and elective modules that shape this dynamic curriculum.

Table of Contents

What is BCOMPT?

A BCompt refers to a Bachelor of Accounting Science degree. It’s an undergraduate programme that focuses on accounting and financial management. This degree typically covers various accounting principles, financial reporting, taxation, auditing, and other related subjects. It’s designed to provide students with a strong foundation in accounting and prepares them for careers in the accounting and finance sectors.

Core Subjects

Bachelor of Accounting Science (BCompt) programme is designed to foster expertise in accounting and finance while instilling a strong sense of ethical responsibility. This esteemed course prepares students with a comprehensive understanding of financial principles, ethical considerations, and practical skills essential in today’s business landscape.

Financial Accounting: This subject covers the fundamental principles and practices of accounting. Students learn how to record, summarise, and present financial transactions of an entity. It includes topics like the accounting equation, preparation of financial statements (income statements, balance sheets, cash flow statements), and understanding Generally Accepted Accounting Principles (GAAP).

Management Accounting: Focused on internal decision-making, this subject deals with analysing financial information to aid management in planning, decision-making, and control. It includes costing methods, budgeting, variance analysis, and performance measurement. Students learn to interpret financial data to assist organisations in making strategic decisions.

Taxation: This subject introduces students to tax laws and principles, enabling them to understand the complexities of taxation systems. It covers direct and indirect taxes, tax planning, compliance, and reporting. Students learn about various taxes such as income tax, value-added tax (VAT), and corporate tax.

Auditing: Auditing is about assessing and verifying financial information to ensure accuracy and compliance. Students learn audit methodologies, risk assessment, internal controls, and ethical considerations in auditing. The focus is on gaining assurance on the reliability of financial statements and processes.

Business Law: Understanding legal frameworks is crucial for accountants. This subject covers commercial and corporate laws, contract law, and regulatory compliance. Students gain insights into how legal aspects influence accounting practices, business transactions, and corporate governance.

These core subjects provide a strong foundation in accounting principles, financial reporting, analysis, legal aspects, and managerial decision-making – essential skills for a successful career in accounting and finance.

Various Modules of BCOMPT Programme

Here’s an overview of the modules within the Bachelor of Accounting Science (BCompt) programme:

Economics I:

- This module introduces fundamental economic principles, theories, and concepts. It covers topics like microeconomics, macroeconomics, supply and demand, market structures, and economic policies.

Financial Accounting I, II, III:

- These modules progressively cover the principles, methods, and practices of financial accounting. They include topics like recording financial transactions, preparation of financial statements, analysis of financial data, and compliance with accounting standards.

Business Management I:

- This module provides an introduction to basic business management concepts, including organisational structures, leadership, planning, decision-making, and business strategy formulation.

Computer Skills I:

- This module focuses on basic computer literacy, covering essential software applications, file management, data processing, and information retrieval.

Business Communication I:

- Business Communication covers effective communication in a business context, emphasising written and oral communication skills, presentations, and professional correspondence.

Commercial Law I:

- This module introduces the fundamental principles of commercial law, including contracts, property law, business entities, consumer protection, and legal frameworks relevant to business operations.

Business Ethics I:

- This module explores ethical issues in business, discussing ethical decision-making, corporate social responsibility, and ethical frameworks in the business environment.

Mathematics I:

- Mathematics for Accounting covers foundational mathematical concepts and applications relevant to accounting and financial analysis.

Auditing II, III:

- These modules delve into auditing principles, practices, and standards, focusing on internal and external audit processes, risk assessment, and audit reporting.

Taxation II, III:

- Taxation modules cover various aspects of taxation, including principles of taxation, tax laws, tax compliance, and tax planning for individuals and businesses.

Statistical Analysis II:

- Statistical Analysis introduces statistical methods and tools for analysing data and making informed business decisions.

Company Law II:

- This module explores company law, including corporate governance, company structures, legal responsibilities, and regulations governing companies.

Management Accounting II:

- Management Accounting focuses on managerial decision-making by analysing financial information, cost management, budgeting, and performance evaluation.

Accounting in a Computerised Environment II:

- This module explores the use of accounting software and technology in modern accounting practices.

Cost and Management Accounting III:

- This module covers advanced concepts in cost accounting, budgeting, cost control, and management decision-making using accounting information.

Risk and Financial Management III:

- This module delves into risk assessment, financial planning, and strategic financial management to manage financial risks effectively.

Corporate Governance III:

- Corporate Governance focuses on principles and practices ensuring ethical decision-making and accountability in corporate entities.

Career Opportunities after Pursuing BCompt :

BCompt programme opens up a range of career opportunities in the field of accounting, finance, and business. Here’s a detailed overview of potential career paths and the earning potential in African currency:

- Chartered Accountant (CA):

- Role: CAs manage financial accounts, audit financial statements, offer financial advice, and ensure compliance with tax regulations.

- Earnings: In South Africa, entry-level CAs typically earn between ZAR 300,000 to ZAR 550,000 per year. With experience and expertise, this can increase significantly, reaching millions of seasoned professionals.

- Financial Manager:

- Role: Responsible for overseeing an organisation’s financial health, financial managers handle financial planning, reporting, and investment activities.

- Earnings: Entry-level salaries for financial managers range between ZAR 300,000 to ZAR 600,000 annually. Senior financial managers can earn several million Rand per year.

- Tax Consultant:

- Role: Tax consultants advise clients on tax-related matters, including compliance, minimising tax liabilities, and ensuring adherence to tax laws.

- Earnings: Starting salaries in tax consulting average between ZAR 250,000 to ZAR 500,000 annually. Experienced consultants can earn over ZAR 1,000,000 per year.

- Auditor:

- Role: Auditors examine financial records, assess internal controls, and ensure financial accuracy and compliance.

- Earnings: Entry-level auditors earn between ZAR 200,000 to ZAR 400,000 per annum. Senior auditors with experience may earn up to ZAR 800,000 annually.

- Financial Analyst:

- Role: Financial analysts analyse financial data, assess investment opportunities, and provide recommendations to improve financial performance.

- Earnings: Entry-level analysts earn around ZAR 250,000 to ZAR 500,000 per year, while experienced analysts can earn over ZAR 1,000,000 annually.

It’s important to note that salaries can vary based on factors like experience, qualifications, location, and the specific industry. Additionally, pursuing professional certifications like CA (SA), CIMA, or ACCA can significantly impact earning potential.

Conclusion

The Bachelor of Accounting Science (BCompt) equips graduates with the knowledge and skills required for these roles, offering a strong foundation for a successful career in accounting and finance. The BCompt programme at Regenesys not only imparts technical skills but also nurtures critical thinking, problem-solving, and ethical decision-making. To explore more about the Bachelor of Accounting Science at Regenesys School of Finance.

Breaking Down the Bachelor of Accounting Science (BCOMPT) Curriculum – FAQs

What is a Bachelor of Accounting Science (BCompt) programme?

A BCompt programme is an undergraduate programme focused on accounting and financial management. It provides students with a comprehensive understanding of accounting principles, financial reporting, taxation, auditing, and business management.

What are the career opportunities after completing a BCompt programme?

BCompt graduates can pursue various roles such as Chartered Accountant (CA), Financial Manager, Tax Consultant, Auditor, Financial Analyst, and more within the accounting, finance, and business sectors.

What are the core subjects covered in a BCompt programme?

Core subjects typically include Financial Accounting, Management Accounting, Taxation, Auditing, Business Management, Corporate Law, Economics, and Information Systems.

Can I pursue professional certifications after completing a BCompt programme?

Yes, BCompt graduates often proceed to pursue professional certifications such as Chartered Accountants (CA) or Certified Management Accountants (CMA) to enhance their career prospects further.

What skills do I develop during a BCompt programme?

A BCompt programme hones skills like financial analysis, problem-solving, critical thinking, communication, attention to detail, and an understanding of financial laws and regulations.

What is the duration of a BCompt programme, and can I pursue it part-time?

The typical duration of a BCompt programme is three to four years, and some institutions offer part-time options to accommodate working individuals.